Which of the Following Account Groups Includes Nominal Accounts

The owners drawing account. All of a companys income statement accounts and.

Nominal Account Rules Examples List Nominal Vs Real Account

Which of the following account groups includes nominal accounts.

. Rent Revenue Fees Earned Miscellaneous Expense In credit terms of 315 n45 the 3 represents. Common Stock Dividends Income Summary d. In other words nominal accounts are the accounts that report revenues expenses gains and losses.

Rent Revenue Fees Earned Miscellaneous Expense ANSWER. Provisioning domains users groups org. Nominal accounts in accounting are the temporary accounts such as the income statement accounts.

When the company is a sole proprietorship the balances in these accounts will be closed by transferring the net amount. This means that their account balances are transferred to a permanent account. Which of the following account groups are all considered nominal accounts.

Rent Revenue Fees Earned Miscellaneous Expense. Which of the following accounts will not be closed to the capital account at the end of the year. Which of the following account groups are all considered Nominal Accounts.

Nominal accounts in accounting are the temporary accounts such as the income statement accounts. A Rent Revenue Fees Earned Miscellaneous Expense b Cash Retained Earnings Wages Payable c Prepaid Insurance Property Plant Equipment d Capital Stock Dividends Income Summary. A nominal account is an account in which accounting transactions are stored for one fiscal year.

Question 12 Which of the following account groups includes nominal accounts. EXERCISE 5-1 temporary and indic ISE 5-1 Classify the following accounts as real permanent or nominal rary and indicate with an X whether the account is closed. Doing so resets the balances in the nominal accounts to zero and prepares them to accept a new set of transactions in the next fiscal year.

Rent Revenue Fees Earned Miscellaneous Expense On September 1 the company pays rent for 12 months in advance and debits an asset account. Common Stock Dividends Income Summary. Prepaid Insurance Equipment Fees Earned c.

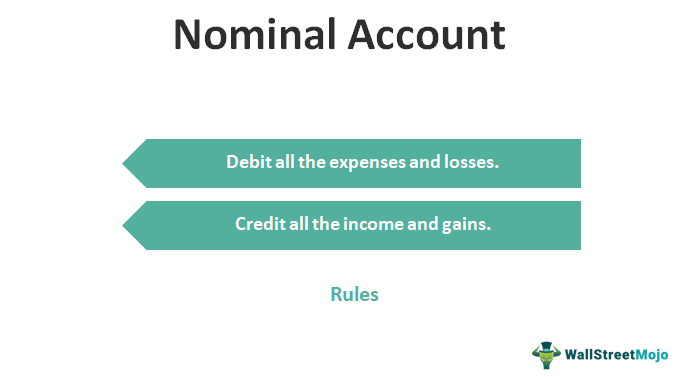

Temporary accounts are zeroed out by an action called closing. Which of the following account groups can be classified as a Nominal accounts A Accounts of Buyer Suppliers Owners Lenders etc. Examples of Nominal Accounts.

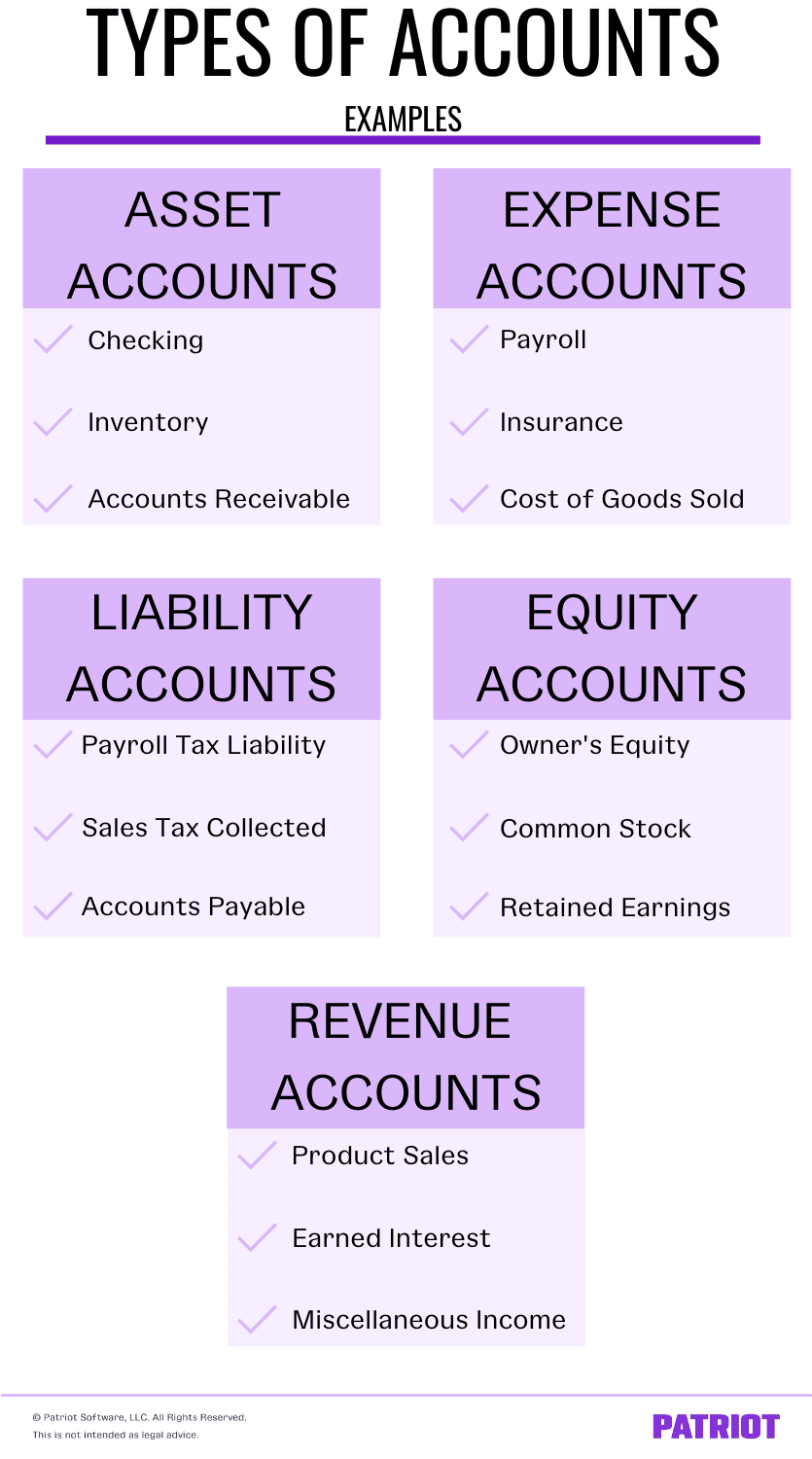

In the above question all the accounts are revenueexpense accounts except for Outstanding Salaries account which is a liability account the balance of. 3 Different types of accounts in accounting are Real Personal and Nominal Account. Rent Revenue Fees Earned Miscellaneous Expense.

The outcome of a nominal account is either profit or loss which is then ultimately transferred to the capital account. This closing process allows the. Cash dividends wages payable C.

The income statement accounts record and report the companys revenues expenses gains and losses. Which of the following accounts is considered a temporary or nominal account. C postages and telephone account.

Which of the following account groups are all considered nominal accounts. Temporary accounts come in three forms. In other words nominal accounts are the accounts that report revenues expenses gains and losses.

The nominal accounts include. Prepaid Expenses Unearned Revenues Fees Earned. Permanent accounts are found on the balance sheet and are categorized as asset liability and owners equity accounts.

The correct answer is B. B furnitures and fittings account. Temporary accounts are also referred to as nominal accounts and they are the accounts that are closed when the year ends and began afresh the following accounting period and they basically relates to fees expenses and gains.

Group of answer choices a-Prepaid Rent b-Rent Revenue c-Rent Expense d-Income Summary. Which of the following account groups are nominal accounts. Revenue expense and drawing accounts.

Nominal Accounts are accounts related and associated with losses expenses income or gains. Which of the following account groups can be classified as a Nominal accounts. Which of the following account groups includes nominal accounts.

Cash Dividends Wages Payable. Real account is then classified in two subcategories Intangible real account Tangible real account. E discount allowed account.

Temporary accounts are also called nominal accounts. Prepaid Insurance Equipment Fees Earned. Rent revenue fees earned miscellaneous expense.

Rent Revenue Fees Earned Miscellaneous Expense. Cash Fees Earned Unearned Revenues. Examples include a purchase account sales account salary AC commission AC etc.

At the end of the fiscal year the balances in these accounts are transferred into permanent accounts. In this article we will see the 3 golden. They are closed at the end of each accounting year.

BAccounts relating to expenses and Income such as sales purchases Discount Allowed. Must be journalized and posted. Group of answer choices a-Prepaid Insurance b-Unearned Service Revenue c-Fees Earned Revenue d-Prepaid Advertising Which of these accounts is never closed.

Which of the following account groups are nominal accounts. Nominal accounts in accounting are the temporary accounts such as the income statement accounts. AAccounts of Buyer Suppliers Owners Lenders etc.

Cash Dividends Wages Payable b. Also three different sub-types of Personal account are Natural Representative and Artificial. A Cash Dividends Wages Payable B Prepaid Insurance Equipment Fees Earned C Common Stock Dividends Net Income D Rent Revenue Fees Earned Miscellaneous Expense.

Types Of Accounts In Accounting Assets Expenses Liabilities More

Comments

Post a Comment